Tips for self-employed cleaners

Information about the Helpling platform

- Compare ratings and prices

- Personal customer service

- Liability insurance up to 5 million euros

- No contract term, can be terminated at any time

Infoportal

The most important points

- Germany has a mandatory health insurance system. This means that every person who lives in Germany – and it does not matter what visa or work permit you have – must be insured through a public or private health insurance company

- An international health insurance or a travel insurance is NOT sufficient. You must be insured through a German company

- If you are from Europe (and have a European passport) you need to register with a German health insurance provider within three months of your arrival in Germany

- The European EHIC card is only for holiday stays and emergencies and does NOT cover you if you are staying in Germany for the purposes of working

- If you already have a health insurance in Germany and recently started to work as a freelancer, your insurance premiums might be too high and it might be possible to arrange for lower premiums

- If you do not have a health insurance in Germany, the consequences can be serious: the German government can charge penalty fees retroactively for up to five years. You could also loose your working permit or work visa

- An international insurance is not sufficient as proof of prior insurance. You need a German health insurance

Contact

Therefore, we recommend you to seek professional advice about health insurance in Germany, especially if you have a visa appointment coming up or you are unsure about your status or insurance options.

How do I get a certificate of good conduct?

You can get a certificate of good conduct at the “Bürgeramt” (local council), without an appointment. Simply go there and ask for a ‘Polizeiliches Führungszeugnis’ or apply for it online here.

Customers who book through the Helpling platform are guaranteed a selection of things:

- Insured cleaners

- Independant local cleaners

- Vetted cleaners

This means that to become active on the platform you will need to become/be vetted.

In whole Germany the certificate of good conduct costs 13 Euro

Do apply for the certificate of good conduct you need your identity card or passport.

When you receive your criminal record, please upload it on your profile.

If you still have questions feel free to give our team a call. You can reach them on +49 30 568 38030.

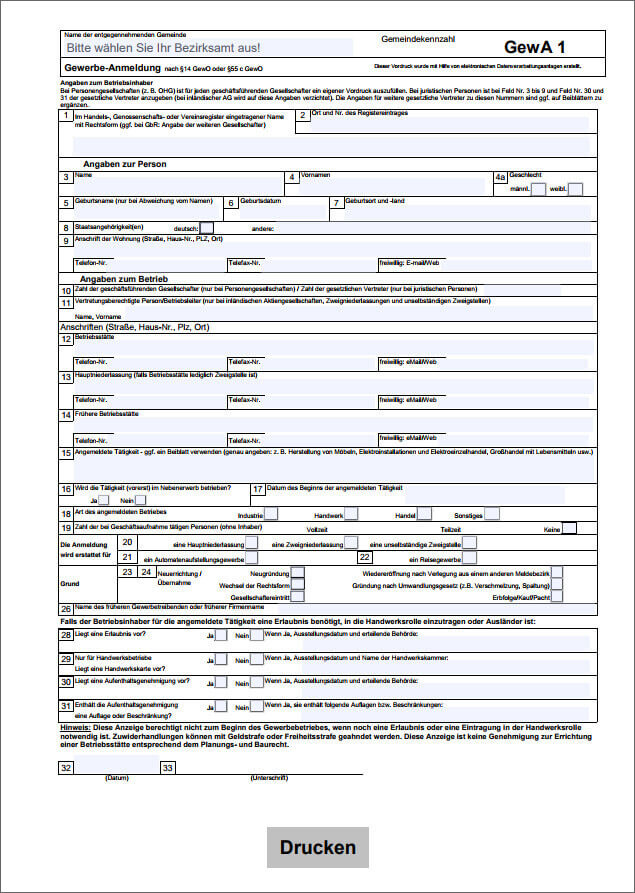

Business license

Helpling works together with self-employed cleaners. Thus, you freely decide where, when, and how many offers you accept. If you want to become self-employed, you need a business licence. You will receive this from the appropriate authorities on the same day!

How it works:

Step 1:

Download and complete the business license form. For help, completed form is provided.

Form: Berlin

Step 2:

To get your business license, you will need to make an appointment at your local “Gewerbeamt/Ordnungsamt”. Please find below the links to your local sites. Please note that not all cities provide english translations of the websites:

Value added Taxes:

Many self-employed cleaners are “Kleinunternehmer” (small businessmen)! Kleinunternehmer are exempted from the Umsatzsteuer (§ 19 UStG). Businesses can count as small business if the turnover, including the applied taxes, in the last legal year was below 17 500 Euro and will presumably not surpass 50 000 Euro in the current legal year.Income tax:

At a taxable income of below 8 820 Euro, self-employed cleaners normally do not have to pay income tax (§ 32a EStG). If you earn more than that you can calculate your payable income tax Einkommenssteuerrechner des Bundesministeriums der Finanzen.Business tax:

Up to a business revenue of 24 500 Euro self-employed cleaners can be exempted from the business tax (§ 11 GewStG).This is how you become an active cleaner on the helpling-platform

- Registerhere as a self-employed cleaner

- Enter the postal code to receive offers in your area

- Enter your contact details and create your free profile

- Answer the last questions about your profile

- Once you have created your profile, Helpling will contact you to guide you through your profile

- Send us a copy of your ID, your business license, and your certificate of good conduct via one of those channels:

Cleaning Tips from the expert Roxanna Pelka

Roxanna Pelka is a trained domestic manager. In the context of textile and object care, she has taught trainees, among other things, the system of room cleaning as well as the chemical processes and composition of cleaning materials. Afterwards, she spent years working in 5-star hotels in Berlin and the Maldives as Assistant Housekeeping Manager. There, she was responsible for the control of the rooms. She is working at Helpling since 2014 and is the contact person for the cleaners using the Helpling platform.